Andrada Mining says it aims to complete the process of finding a lithium development partner for its Uis mine in Namibia by September.Â

This comes as the company in May appointed Barclays’ investment banking arm as a strategic adviser after receiving “numerous” unsolicited approaches from potential partners for the development of its lithium mine.Â

Barclays was appointed to lead the strategic assessment alongside Andrada’s existing advisory and financing partners, with the aim of finding the most suitable funding arrangement based on existing and proposed options.

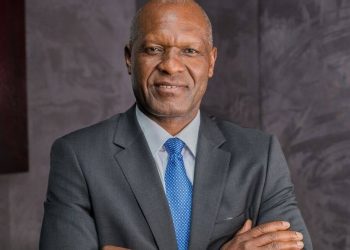

“The strategic process to identify the appropriate partner to participate in the lithium development is progressing as planned with site visits to Uis mine by interested parties completed. The entire strategic process is targeted to conclude at the end of September 2023,â€Â Andrada Mining CEO Anthony Viljoen said.

“The ongoing strategic process to identify a partner for the lithium development is going well and will transform Andrada from being a fledging developer to a fully-fledged miner of technology metals. We have been encouraged by the level of interest from potential lithium partners globally and are confident of being able to conclude an attractive transaction for shareholders and broader stakeholders this year.â€Â

The company in its first quarter operational update for the period ended 31 May 2023, said construction of the on-site (lithium) bulk-sampling pilot plant is on schedule and on budget for completion at the end of June 2023.

“Management have internally estimated that this facility could generate annual early revenues of between US$5 million to US$20 million at the upper levels of production assuming an average grade of 4.0% Li2O and an average petalite price of US$2,000 per tonne,†the company said adding that during the quarter available funds were mainly utilised for the completion of bulk-sampling pilot plant and tantalum circuit.

Andrada said the company management expects the completion, and associated drawdown of the N$100 million (US$5.5 million) senior secured debt facility with the Development Bank of Namibia during July 2023, citing progress in concluding the inter-creditor agreement in June 2023.

“Completion of the Facility remains subject to a series of final conditions including the execution of an inter-creditor agreement between the DBN and Standard Bank (which has been agreed in principle) and finalisation of the associated security package.â€

Andrada Mining Limited, formerly Afritin Mining Limited, is a London-listed technology metals mining company with a vision to create a portfolio of globally significant, conflict-free, production and exploration assets.

Â

Â

Â