The Government Institutions Pension Fund (GIPF) says it expects to finally roll out pension-backed home loans to help workers secure houses in the coming weeks.

The pension home loan scheme mooted by the GIPF will allow its members to use their pensions as collateral to purchase a house or carry out renovations and will also allow funding for the construction of property even in rural areas.Â

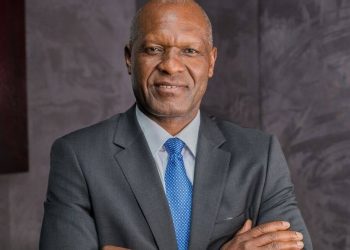

“Home-backed loans are an important element which I will soon hope to sign before I depart. In the coming week we shall announce the grand signing of this beneficial initiative,†outgoing GIPF Chief Executive Officer David Nuyoma said on Monday after bidding farewell to President Hage Geingob.

“It is very important to our members, taking cognisant that only 30% of our members have decent shelter, hence it is pivotal to have it in motion and assist those who may not qualify for loans from commercial banks to either build or upgrade their dwelling wherever they reside.â€

The new scheme is expected to help Namibia navigate its housing crisis, where the country needs at least half a million new homes to meet rising demand. According to the World Economic Forum, at least 90% of Namibian households are not eligible for mortgages.

Speaking on his exit, Nuyoma, who is on a second extension of two months till August since his 10-year tenure came to an end in December 2022, said he was able to take the Fund to greater heights, growing it from N$58 billion when he joined to its current value of N$157 billion.

“I would like to thank the President for according us a solid business environment where GIPF under his leadership was able to flourish and enable us to take autonomous decisions for the benefit of our members. Therefore, I am happy to say, GIPF is in a liquid state,” he said.

He said the Fund’s board led by Nilian Mulemi was currently working on the recruitment process of a new CEO.

“They are currently busy with that, that is why they had asked me to stay longer so that they could finalise the process,†Nuyoma said.

On his future plans after retirement, he said, “all in all, as a patriotic citizen, I will be available and around to assist wherever possible.â€

GIPF is a statutory pension fund that provides guaranteed pension and related benefits to 98,623 civil servants, and employees of participating employers in Namibia.