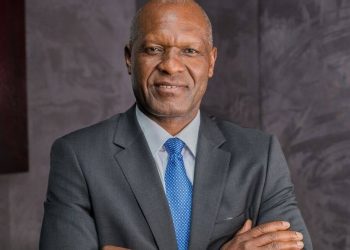

South African Reserve Bank (SARB) governor Lesetja Kganyago says that inflation is ravaging the incomes of South Africans and that the central bank will continue using its current hiking policy to bring it under control.

The SARB Monetary Policy Committee (MPC) on Thursday (24 November) announced another interest rate hike of 75 basis points (bp), marking the third hike of this quantum in a row, and taking the cumulative hike in the current cycle to 350bp.

The repo rate is now sitting at 7.00%, with the prime lending rate at 10.50%.

The vote was not unanimous, with three members of the committee voting for 75bp and two members voting for 50bp.

Commenting on the hike, Kganyago defended the move, saying that it was a necessary measure to deal with inflation, which remains stubbornly high in the country.

Inflation data from Stats SA earlier this week surprised economists and analysts – and even the SARB – coming in marginally higher at 7.6%. Markets anticipated a slight drop to 7.4%, while the central bank expected 7.3%.

The fact that inflation figures surprised by climbing – and the fact that core inflation, removing shocks like energy and food, continues to rise and is now sitting at 5% – is proof enough that rising inflation is broad-based, Kgaynago said.

This is enough to justify the rate hike.

“There’s nothing we can do about September or October inflation. That is water under the bridge. We can do something about future inflation, and the response of the MPC with this policy decision is to respond to the future pressures that could build up,†he said.

“Let’s be clear, the current elevated levels of inflation are not good for growth; they undermine growth. Unless we tame the monster of inflation, we cannot have balanced economic growth in this country.â€

Whether inflation is being driven locally or internationally, Kganyago said it is here, and it needs to be dealt with because it is eroding the income of South Africans.

The Reserve Bank’s long-term model sees the repo rate at 7.00% as the stable position; however, that does not mean that no more rate hikes are coming.

Kganyago said that the central bank isn’t looking simply for inflation to peak but for it to show a steady and consistent path back to the 4.5% range.

“When that is, we will see. We have taken a series of policy adjustments, and these are starting to feed through into economic activity. If it is not having an effect, we will continue making adjustments until it does.

The governor said that it is important that the central bank continues to deploy its instruments with certainty so players in the economy can act with certainty, knowing that inflation is under check.

“Of course, there could be a risk of over-tightening, but that risk is not here now. Inflation is here with us – and with inflation expected to remain with us, projected outside of the inflation target into next year, we can’t say there is a risk of tightening as yet,†he said.

Kganyago said that economic history offers important lessons in this regard. He noted that in the past, when central banks saw a risk of over-tightening and then under-tightened, inflation ran ahead of them and then central banks found themselves having to correct, increasing rates even more aggressively and thus choking economic growth.

“We take the view that the rate hike is consistent with the forecast, and as new data comes in, we will adjust policy as needed,†he said.

Economists noted that the SARB’s tone following the rate hike remains hawkish, with the ‘close call’ nature of the hike opening the door for another 50bp hike in January.

“This will come down to ‘data dependence’ from now until then,†said Jeff Schultz, senior economist at BNP Paribas.

“Further upside inflation surprises, a weaker rand and tighter global financial conditions could easily challenge our current forecast for a terminal rate of 7.50%, we think. We keep our call for a final 50bp hike in January.â€

Carmen Nel, economist at Matrix Fund Managers, said the market is currently pricing in a cumulative 50bp in hikes by March 2023, which reflects the risk for a 25bp hike rather than a 50bp hike in January