The FNB House Price Index was up by 9.6% y/y at the end of June 2021, following a contraction of 1.0% y/y over the same period last year.

Consequently, the national weighted average house price came in much stronger at N$1 286 908, compared to N$1 042 852 seen in a prior year, the bank said.

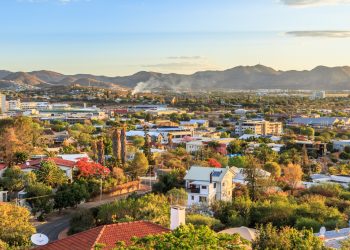

“These trends mirror the considerable increase in mortgage sales across the board – with a relatively high growth impact coming through from the medium and large housing segments. This also reinforces the narrative that Namibia is currently in a buyers’ market, making it a good time to invest in a property or a dream home,†said Frans Uusiku, FNB Market Research Manager.

On a three-months basis, the medium and large housing segments contracted by 0.7% and 4.1% y/y to N$2 146 000 and N$4 045 000 at the end of June 2021, respectively.

These dynamics reflect the emergence of cyclical forces such as distressed property sales induced by weak economic conditions and affordability issues he said, noting that sales of homes within the medium and large housing segments soared by 34.9% and 53.4 y/y over the review period compared to contractions of 20.5% and 1.7% recorded a year earlier.

“On a more positive front, green shoots in house price growth were observed within the small and luxury segments, registering growth of 7.1% and 95.3% y/y, respectively. This points to the resilience of these segments from a demand and affordability perspective. Suffice to say, a house in the small segment tend to sell quick, averaging about 1-4 months in the market, if reasonably priced.â€

The review of trading activity in the second quarter also paints an uprise of the affordable housing market or selling of houses that are priced below N$500 000, with the northern and central regions responsible for most of the deals concluded in this segment, accounting for 38% and 37%, respectively.

“Although the economy remains in a relatively weak position, the housing market is showing some signs of a return to normal. In fact, buying conditions for houses have improved and are back to where they were about two years ago. However, affordability is expected to remain challenging as the labour market is still reeling from the impact of Covid-19 pandemic. Over time, as the policy momentum on affordable housing continues to gain traction, we expect price pressure to soften as newly completed homes help increase inventories from their current low levels,†Uusiku said.

Â

Â