By John-Morgan Bezuidenhoudt

In the intricate process of budget formulation and the balance between projected revenues, expenditures, and borrowing costs is often treated as a precise science.

However, beneath this veneer of rationality lies a far more unpredictable force: the psychology of markets. Keynes’s concept of animal spirits reveals that economic decisions are rarely based solely on cold, hard facts – they are driven by instinct, emotion, and sometimes irrational exuberance. A country’s budget, therefore, isn’t just a matter of numbers; it’s vulnerable to the whims of investor sentiment and global market psychology.

The sentiment around Namibia’s fiscal health has been remarkably positive over the last 18 months as interest rates remained relatively low, the economy saw a boost in economic activity on the back of foreign direct investment and the budget has been successfully executed. However, this optimism must not be taken for granted.

When optimism turns to anxiety or speculative fervour overtakes caution, the cost of borrowing can soar, sending interest expenses spiralling beyond expectations. This psychological turbulence, often lurking just below the surface of fiscal planning, can turn a seemingly stable budget into a financial minefield, where interest payments become the hidden drain on the fiscus.

More specifically, there exists a notable opportunity for market sentiment to temper investor exuberance, particularly considering several critical factors. A revenue shock – where government revenues fall short of expectations – coupled with the government’s cash-strapped position, can significantly undermine investor confidence.

This is further exacerbated by a large local maturity profile, where substantial debt repayments loom on the horizon, creating additional fiscal pressure. Moreover, an ambitious spending plan, if perceived as overly optimistic or unsustainable given the current fiscal constraints, can heighten concerns about the government’s ability to meet its financial obligations.

These factors can combine to shift market sentiment from optimism to caution, leading investors to reassess risk, demand higher yields, and reduce their exposure to government debt, all of which can drive borrowing costs higher than initially projected.

The Ministry of Finance (MoF) expects the deficit to grow to 4.6% of GDP in FY 25/26, resulting in a deficit of N$ 12.8bn – N$1.1bn above the mid-year estimate. This has cascaded down and resulted in a downward revision of the primary surplus from N$1.3bn to N$915mn (to 0.3% of GDP) in FY25/26.

Thereafter, the deficit is expected to decrease over the forecasted period moving down to 4.0% and 3.0% of GDP in the subsequent financial years. There is a risk associated with the widening deficit, mainly since revenue drivers (SACU Receipts and diamond mining related taxes) have come under immense pressure.

Furthermore, Namibia’s deficit as a percentage of GDP is expected to print at similar levels to South Africa into FY25/26 although South Africa only expects GDP growth of 2% whereas Namibia expects GDP to grow at 4.5%. This is illustrated by figure 1 and suggests that the Namibian government may be pressured into financing the deficit and paying more in interest expense.Â

The MoF expects interest expenditure to tick up to N$13.7bn (14.82% of total revenue) in FY25/26. This is an increase of 6.2% and is mainly driven by an anticipated increase in domestic interest payments (N$10.4bn to N$ 11.0bn).

Conversely, the government anticipates its domestic borrowing costs to move down into FY25/26. There is an evident large risk to the upside as the intuitive assumption behind lower interest rates is that either there will be higher levels of demand for local debt after rolling the Eurobonds or Namibian bonds should be considered to hold lower levels of credit and default risk when compared to South Africa. The MoF ultimately expects the domestic effective interest rate to move down from 8.53% to 7.98%.

The total debt stock is expected to reach N$172bn (62.0% of GDP) in FY25/26 with 85% of the debt stock expected to be local and the remaining foreign. The financing requirement has remained inline with expectations amounting to N$6.0bn.

The sinking fund has been funded with SACU revenue and local bond issuances to execute on the redemption plan for the Eurobond. The sinking fund has accumulated US$463m over the years and an additional US$162m is planned to be allocated this year. That leaves US$125m worth of domestic issuances expected from the domestic bond market.

Therefore, the government is expected to rely largely on domestic issuances to finance the deficit. Domestic financing is expected to amount to N$17.3bn in FY25/26, the second largest domestic financing requirement in the country’s history and will present the largest challenge for government finances.

Basic economic principles suggest that an increase in supply must be matched with demand for interest expense to remain the same – a very ambitious assumption from the ministry to keep interest rates flat or even see them reduce.

Finally, the reliance on SACU receipts is a risky endeavour given the state of geopolitical challenges and other revenue headwinds related to local diamond revenue. We believe that financing needs will likely surprise to the upside.Â

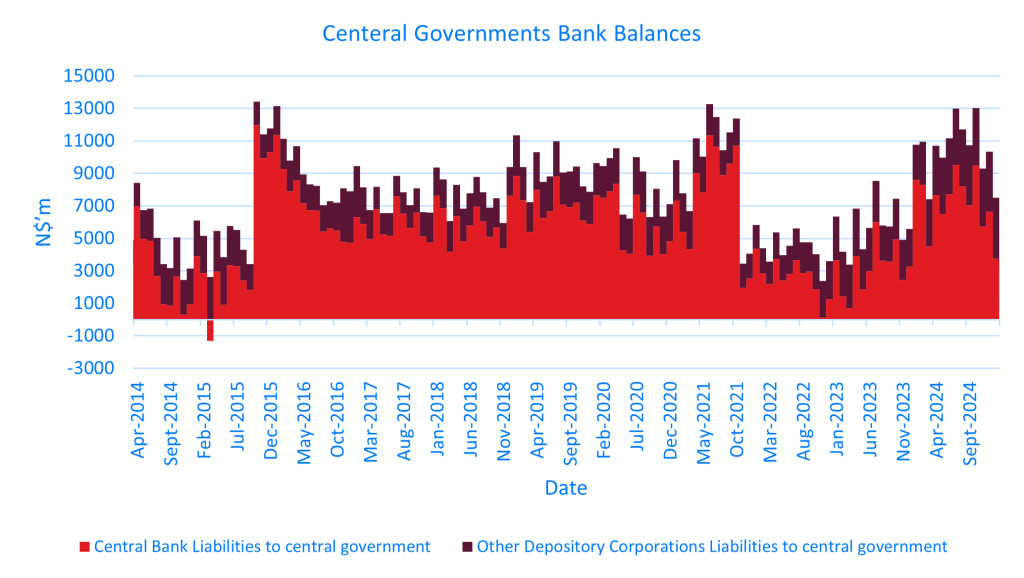

In addition, a large amount of debt obligations is due this year and next, it is likely the government may face fiscal challenges. Figure 2 illustrates the bank balances of government institutions that are held at the bank of Namibia (including redemption accounts for bond issuances).

The government’s latest financial position stands at N$7 billion, but the large repayment due in October is expected to significantly reduce their bank balances.

In 2021 the first Eurobond payment was executed and as a result the government bank balances experienced a sharp negative shock. If the same is to be expected following this year’s Eurobond redemption; lower government balances are to be expected and could force a slowdown in expenditure, which would reduce liquidity in the economy, delay payments to contractors and workers alike, and amplify the broader economic impact.

Concluding remarks

James Carville famously said, “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody”.

This highlights the immense power that the bond market holds over economies and governments. Carville’s statement reflects the profound influence that bond markets have in shaping fiscal policy, economic stability, and investor sentiment.

In the context of Namibia’s national budget, it will be interesting to understand whether investors have confidence in the government’s ability to execute the budget as promised.

A key factor that I will be watching over this financial year is the interest rates that bonds are refinanced at. The upcoming Eurobond repayment and reliance on domestic issuances could strain both liquidity and economic growth.

*John-Morgan Bezuidenhoudt, Portfolio Manager: Â Momentum Investments